tax lien search colorado

Web Colorado currently has 49331 tax liens available as of October 26. Web Colorado Tax Lien Homes.

North Carolina Secretary Of State Uniform Commercial Code Federal Tax Liens

It is in your best interest to continue to endorse pay sub-taxes if the owner has not paid them to.

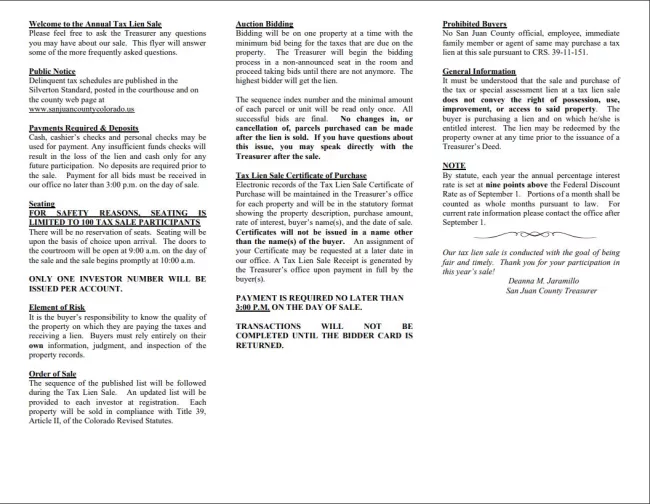

. Web A fee of 220 per searchhistory payable to the Colorado Department of Revenue must be submitted. Search all the latest Colorado tax liens available. Web The 2022 Internet Tax Lien Sale will be held on Nov 3 2022 2022 Interest is 12.

Web The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax debt 39-21-114 3 CRS. Buying tax liens at auctions direct or at. Treasurer Property Tax Search Assessor Property Search.

After application submission and 450 deposit. Internet Tax Sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent.

There are more than 40698 tax liens currently on the market. Web Verify tax lien certificate issuance date has exceeded three years. CDOR will send a Notice of Intent to Issue.

Web Please see Treasurers Deed Information. Submit application and 450 deposit. Wednesday November 17 2021 - 448pm.

Web Search San Miguel recorded documents including property records death records marriage records and tax liens by name document type or date range. Tax Lien Sale List. Property Tax Lien Sale Information.

Web Colorado Tax Lien Homes. Web The annual public auction of real estate tax liens will be held as an internet auction. There are more than 38643 tax liens currently on the market.

Web A tax lien is placed on every county property owing taxes on January 1 each year and remains until the property taxes are paid. REMEMBERyour Tax Lien Sale Certificates of Purchase are important documents. Please call the office at 303-582-5222 if you have.

Web As a tax lien holder you will receive a tax notice after August 1st of each year. Search all the latest Colorado tax liens available. In accordance with 24-35-117 CRS the Colorado Department of Revenue is directed to annually disclose a list of delinquent taxpayers who have owed.

Web Colorado Secretary of State. Buying tax liens at auctions direct or at. Web A tax sale buyer is eligible to apply for a Treasurers Deed on any certificate heshe holds three years after the date of the sale.

Clerk and Recorder of Deeds. In Colorado government agencies that manage lien records like the county clerks office provide free lien searches to interested persons. Web Free Lien Search in Colorado.

Web Delinquent Taxpayers Lists. Web A tax lien is a claim against a property imposed by law to secure the payment of taxes. Web Tax Lien Sale Information.

For certified records an additional 50 per title record or title history request. To apply for a Treasurers Deed please send the. If the property owner does not pay the property.

Delinquent Real Property Taxes will be advertised once a week for 3 consecutive weeks.

Where Are The Tax Sales Tax Lien Investing Tips

Colorado Businesses That Owed State Taxes Got Ppp Loans 9news Com

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Are Liens On Property Public Record How To Check Trelora Real Estate

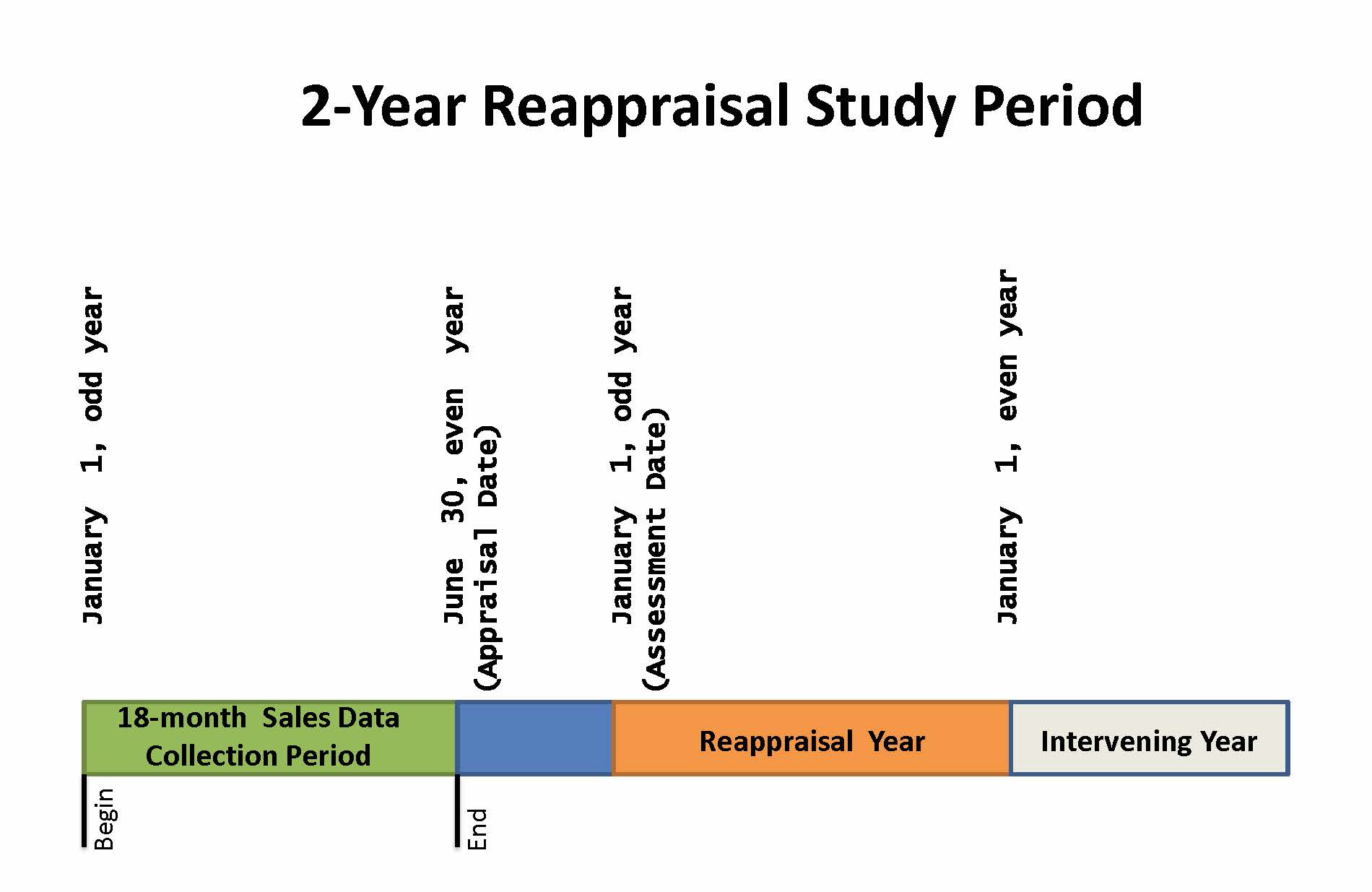

Property Assessment Process Adams County Government

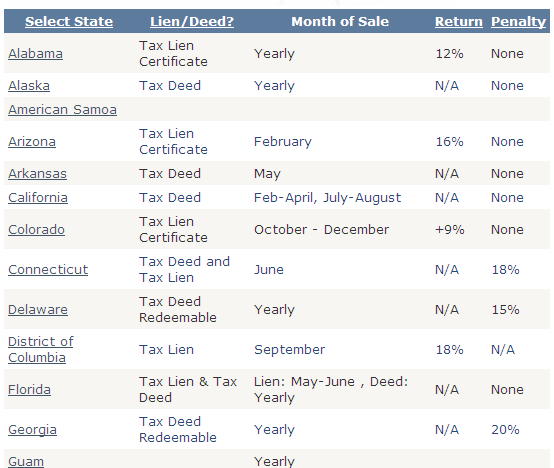

State Directory Tax Sale Resources

Why And How To Apply For A Federal Tax Lien Subordination

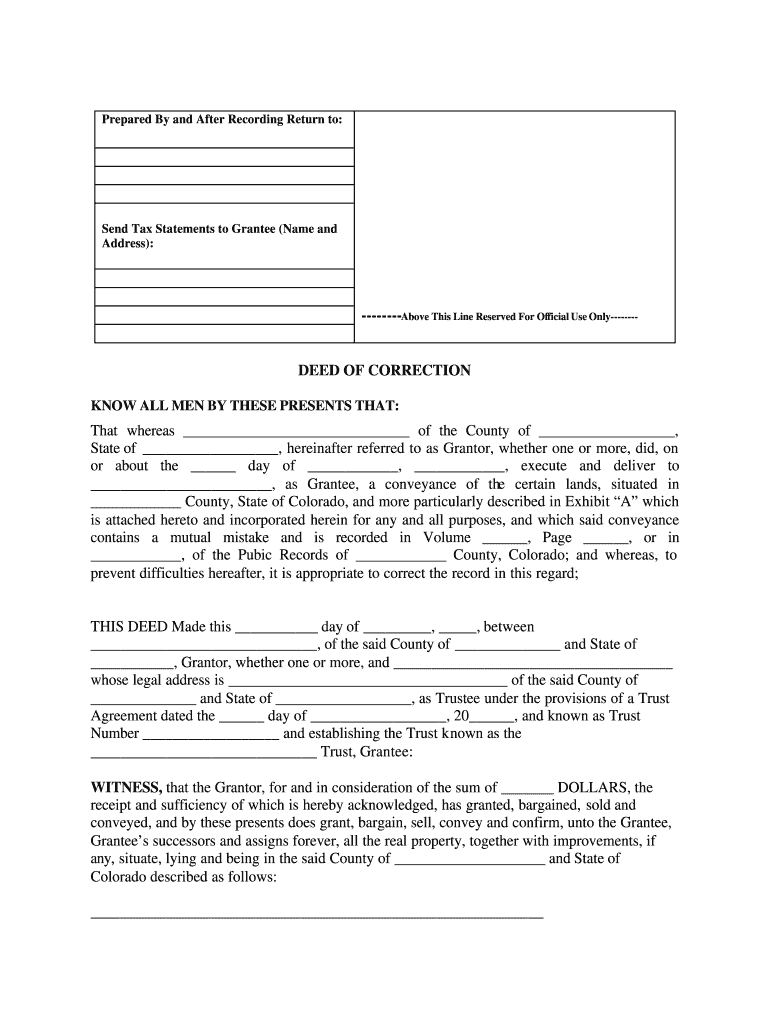

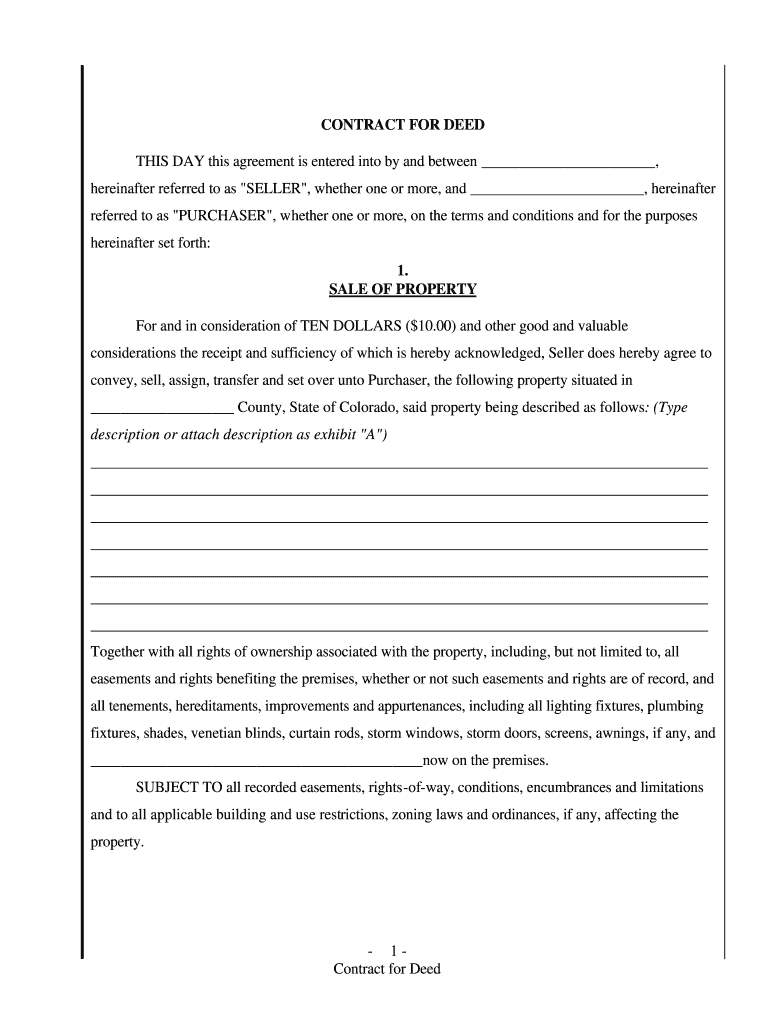

Colorado Correction Fill Out Sign Online Dochub

Colorado Deed Sale And Fill Out Sign Online Dochub

What Is A Real Estate Lien Colorado Real Estate Attorney Joseph P Stengel

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

5 12 3 Lien Release And Related Topics Internal Revenue Service

Your Source For Local News In Golden Colorado Goldentranscript Net