sacramento property tax rate

Automated Secured Property Information Telephone Line. The Yolo County Tax Collectors Office will be open until 500 pm.

The median property tax on a 32420000 house is 220456 in Sacramento County.

. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. If you are not sure of the exact amount of secured property taxes due tax bill amounts are available online. Partial payments cannot be accepted.

Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Sacramento County is located in northern California and has a. Tax Collection and Licensing.

8 hours agoA recent study led by professors at City University of New York and University of Illinois Chicago found commercial real estate specifically accounts for an average of 37 of property taxes in. You may pay your property taxes by credit or debit card a 234 convenience fee will be added or e-check no charge online. Our Mission - We provide equitable timely and accurate property tax.

The assessment roll is the official list of all taxable property within the County. 3 hours agoJEFFERSON CITY Mo. You may also pay by phone 877 590-0714.

Some Missouri homeowners could be spared from paying higher property taxes under a pair of proposed constitutional amendments approved Wednesday by the state Senate. Late payments will incur a 10 percent penalty plus a 1500 cost for each tax bill. Property information and maps are available for review using the Parcel Viewer Application.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. The Sacramento County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. The average effective property tax rate in San Diego County is 073 significantly lower than the national average.

Payments may be made to the county tax. The median property tax on a 32420000 house is 239908 in California. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Last day to pay taxes on unsecured tax bills without penalty. Dept Content HP Col4.

Sacramento CA March 30 2016 The deadline for paying the second installment of your 2015-2016 Sacramento County property taxes are coming up very soon. First day to file assessment appeal applications with the Clerk of the Board of Supervisors. According to the 2021 Annual Report published by the Sacramento County Assessors Office the assessed value for the county increased by over 5 with most properties seeing an increase of 101.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. To look a parcel up through e-PropTax Sacramento Countys Online Property Tax Information you will need the 14 digit parcel number.

This map shows property tax in correlation with square footage of the property. Payments are due no later than April 11 2016. Funds from these sales tax measures are used alongside local property tax revenues and other funds to pay for infrastructure public safety.

3636 American River Drive Suite 200 M ap. On Monday April 11 2022. Close of assessment roll and the start of the new assessment roll year.

Permits and Taxes facilitates the collection of this fee. When calling the Tax Collectors Office your call is answered by our automated information system. Available 24 Hours a day 7 days a week 916 874-6622.

In Sacramento we are experiencing our ninth straight year of property tax increases and dont expect that trend to end in 2022. However because assessed values rise to the purchase price when a home is sold new homeowners can expect to pay higher rates than that. For a current payoff amount for Secured prior year delinquent taxes please call the 24 hour Automated.

View the E-Prop-Tax page for more information. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. The online and phone payment systems will be taken offline after 5.

For more information view the Parcel Viewer page. California Property Tax Rates County Median Home Value Average Effective Property Tax Rate Riverside 304500 097 Sacramento 299900 084 San Benito 459700 082 San Bernardino 280200 083. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

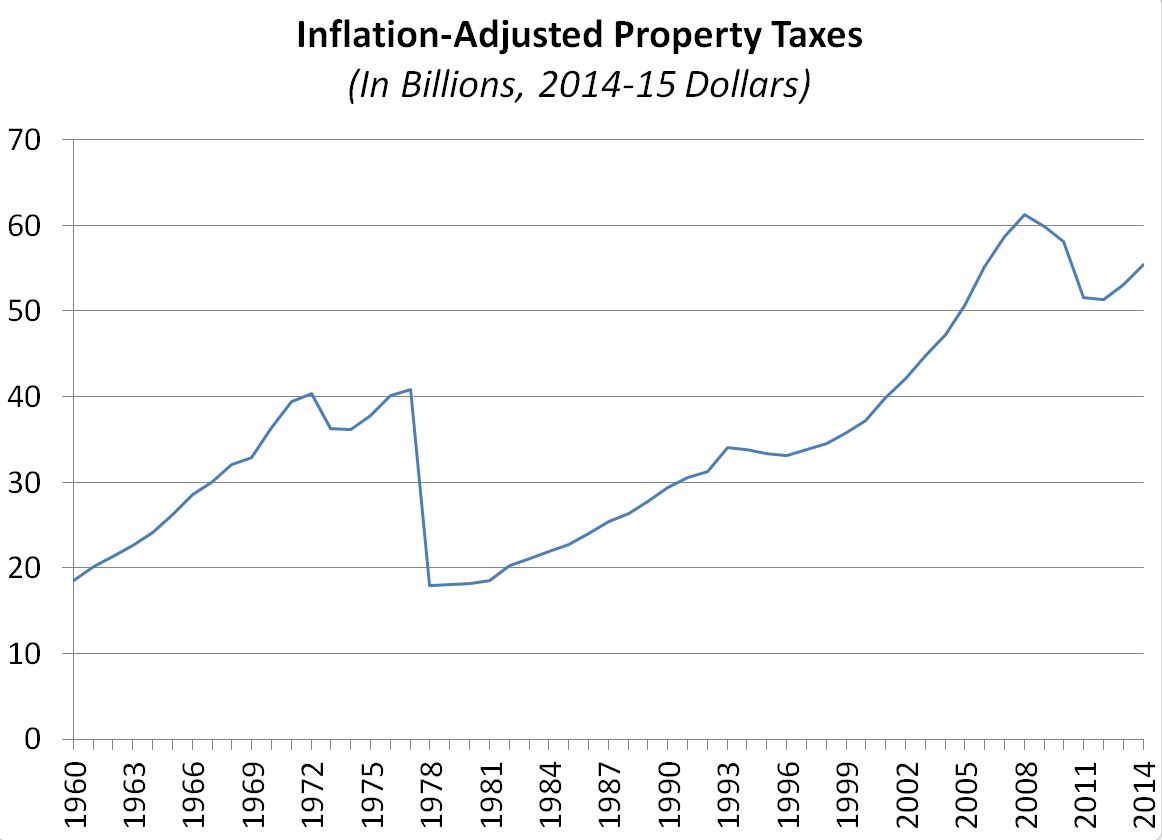

They can be reached Monday 100 pm - 400 pm and Tuesday - Friday. This tax has existed since 1978. The median property tax on a 32420000 house is 340410 in the United States.

In West Sacramento the sales tax rate is 825 percent which includes the state-mandated 725 percent plus four separate ¼ cent voter-approved sales tax measures that fund important local projects.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Understanding California S Property Taxes

Home Market Still Sluggish Sacramento Business Journal Business Journal Marketing Titusville

Affidavit Of Marriage Form Marriage Marriage Registry Marriage Application

Understanding California S Property Taxes

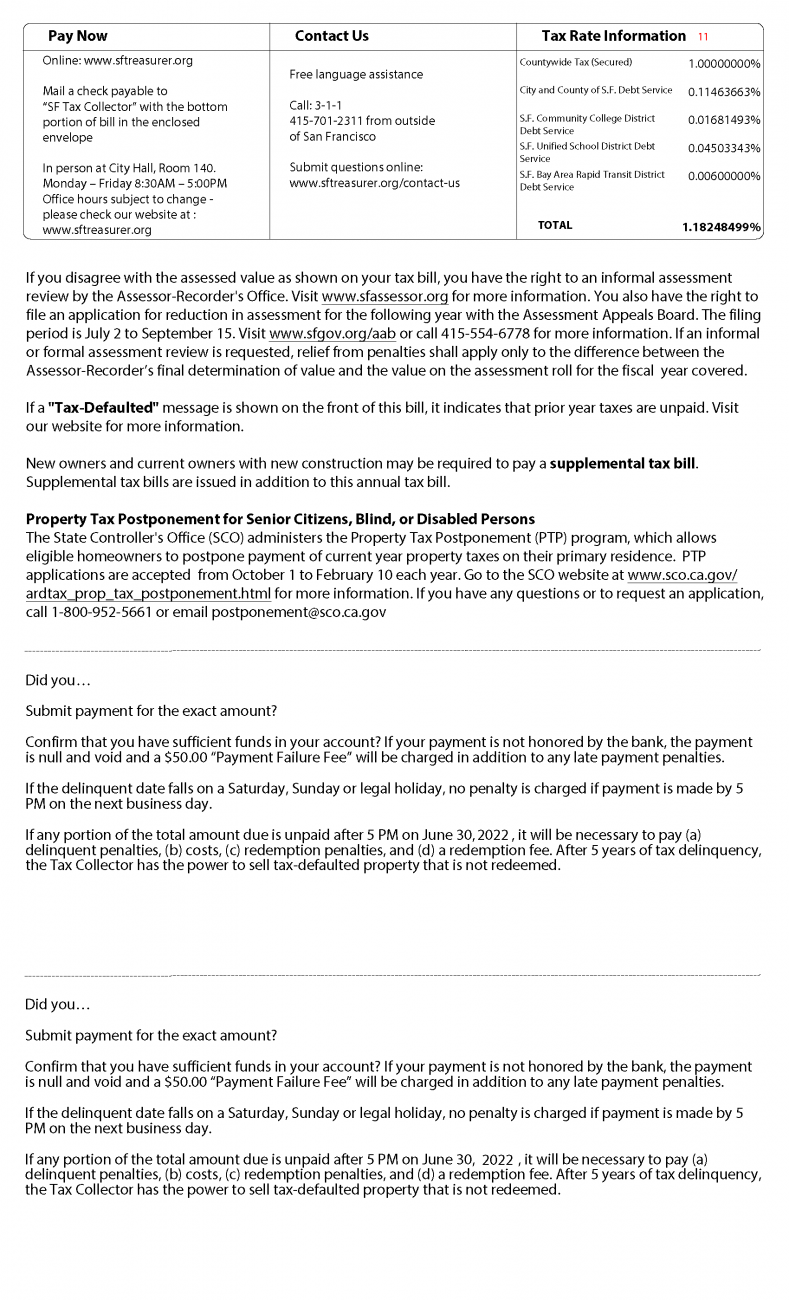

Secured Property Taxes Treasurer Tax Collector

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

2022 California Property Tax Rules To Know

Proposition 13 Report More Data On California Property Taxes Econtax Blog

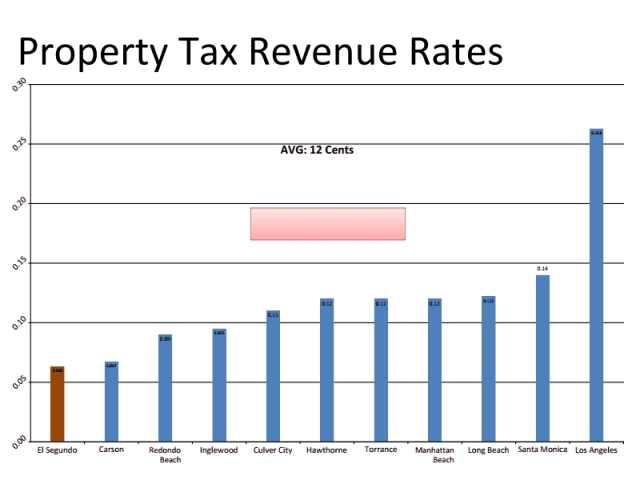

El Segundo To Fight For Fair Share Of Property Taxes Easy Reader News

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

332 Blackbird Ln Sacramento Ca 95831 Black Bird Real Estate Professionals House Prices